Schedule Your Annual Enrollment Appointment Today To Enroll!

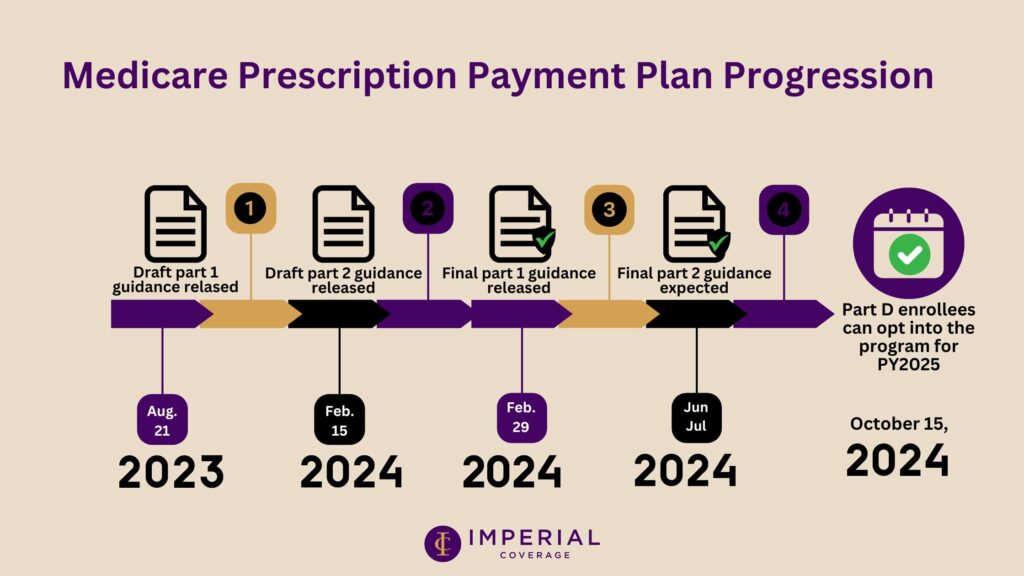

Get ready for a game-changer in managing your healthcare costs! Starting January 1, 2025, Medicare Part D is rolling out an exciting new program under the Inflation Reduction Act. The Medicare Prescription Payment Plan will revolutionize how you pay for your prescription drugs by allowing you to spread out your out-of-pocket costs over the year.

Inflation Reduction Act 2025 Changes:

- $2,000 Yearly Cap: A new $2,000 yearly cap on Medicare prescription drug costs.

- Price Negotiations: Medicare can now negotiate drug prices directly.

- Improved Access and Cost Caps: Improved access to biosimilars and a $35/month cost-sharing cap on insulin in durable medical equipment pumps.

What’s in Store for You:

- Monthly Payment Magic: Say goodbye to unpredictable costs! All Medicare Part D plans will now offer capped monthly payments for prescription drugs, making it easier than ever to budget and manage your healthcare expenses.

- Who’s In?: If you’re enrolled in Medicare Part D, including those receiving Extra Help, you’re eligible to benefit from this groundbreaking payment plan. Those with higher cost-sharing, especially for brand-name or non-preferred drugs, will find this program particularly helpful.

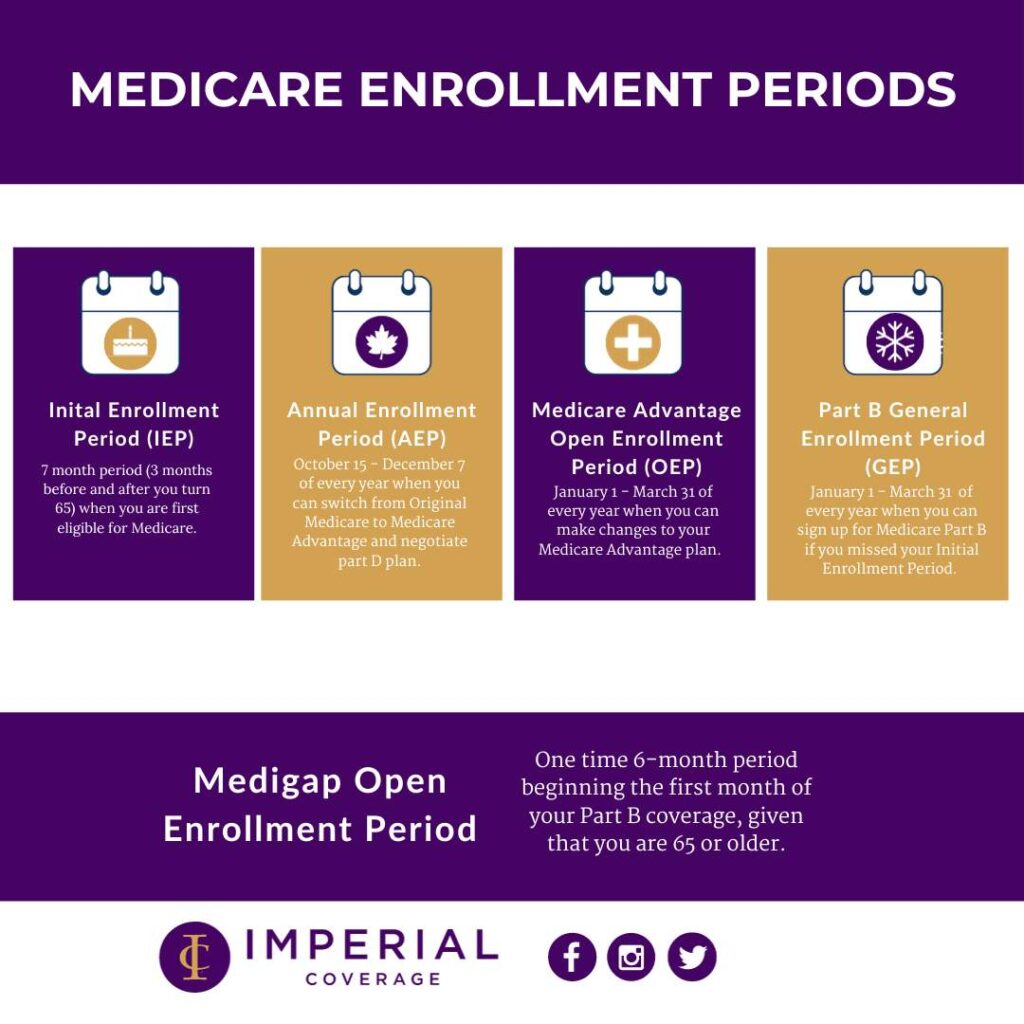

- Opting In Is a Breeze: During the Annual Enrollment Period (AEP) starting in October 2024, you can opt into this program as you enroll or renew your Part D coverage. Already enrolled? No worries! You can jump on board at any time during the plan year by reaching out to your Part D sponsor.

Key Features to Remember:

- Applies to both standalone Medicare prescription drug plans and Medicare Advantage plans with drug coverage.

- This program doesn’t reduce your total prescription drug costs but makes them way more manageable.

- Your Part D sponsor is committed to processing your election requests promptly.

- If you’ve been hit hard with high cost-sharing early in the year, this program could be a game-changer for your budget.

As you prepare for the upcoming changes, it’s important to stay informed and make decisions that align with your healthcare needs and budget. Consider discussing this new payment plan with me during your AEP appointment to see how it fits into your overall healthcare strategy. With the Medicare Prescription Payment Plan, managing your prescription drug costs has never been easier.

REMINDER! Schedule Your Annual Enrollment Period (AEP) Appointment Today!

Don’t wait until the last minute! Schedule your AEP appointment now to get a full coverage review to ensure your 2025 health care needs are in place, and receive assistance in opting into this new prescription payment plan program.

Fill out the 2025 Insurance Updates Form prior to your appointment to streamline the process and make the most of your enrollment period.

To schedule your appointment please contact our office today. We look forward to assisting you with your 2025 healthcare needs!