On March 19, 2020, the U.S. Department of Homeland Security (DHS) announced it will allow employers that are operating remotely to conduct a remote verification of approved Form I-9 documents. Because of ongoing COVID-19 concerns DHS has extended the Form I-9 requirement flexibilities to Oct. 31, 2022

Category: News

HIA-LI HEALTH & WELLNESS + MANUFACTURING/INTERNATIONAL TRADE JOINT COMMITTEE MEETING – ALTERNATIVE HEALTH “CARE”

As proud members of the HIA-LI and the HIA-LI Health & Wellness Committee, we would like to encourage both large and small business owners, Benefit Administrators and HR professionals to join the HIA-LI for this informational presentation via Zoom. Both John Dallo, the Director of Sales at ReviveHealth and Dave Milani the VP of Wellness Solutions at Sunbasket will be presenting.

Non-members: You may attend a complimentary meeting to learn more about the HIA-LI. You will just need to pre-register on the HIA-LI website, so that after the program if you are interested in connecting with the HIA, someone from the HIA-LI can reach out to you.

For sponsorship opportunities, please contact Anthony Forgione at the HIA-LI at aforgione@hia-li.org

How to Appeal the Part D Late Enrollment Penalty Electronically

All enrollees have the right to file an appeal with C2C Innovative Solutions if they believe they have maintained adequate drug coverage.

The easiest and fastest way to submit your Late Enrollment Penalty appeal request is to upload your paperwork to the QIC appeals portal.

Note you have 60 days from the date you received the LEP notice to appeal the decision

Here’s What You’ll Need

- Part D LEP Reconsideration Request Form

- LEP Notice that was sent by the Part D Plan

- Notice of Creditable Coverage

Instructions:

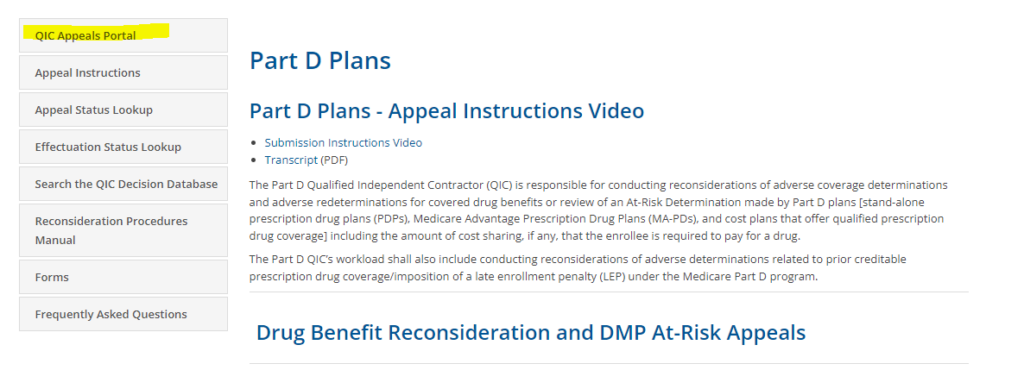

You will need to select Part D Plans to be redirected to the correct portal.

Then you are going to select the option that says QIC Appeals Portal.

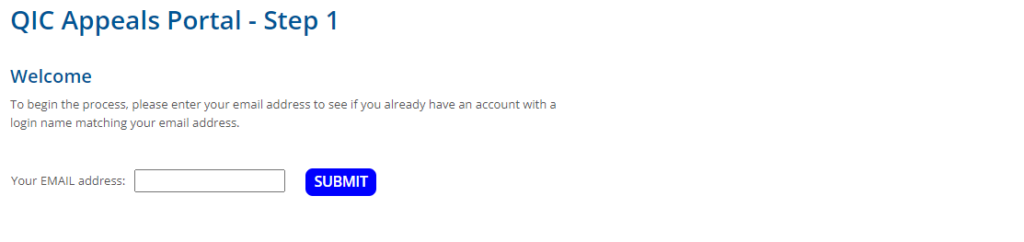

Next, input your email address to verify if you already have an account set up. If not, it will prompt you to set up an account with your email address.

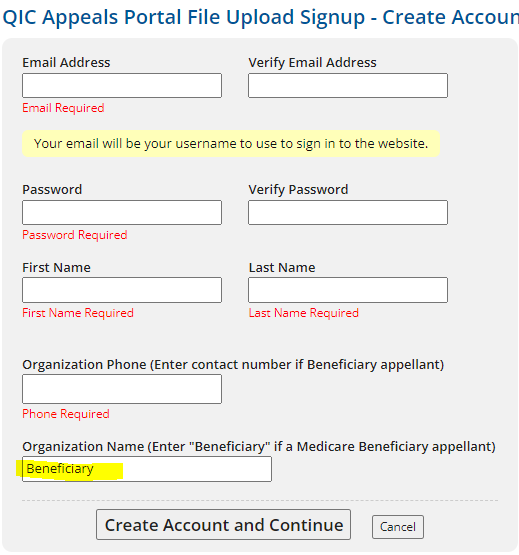

If you need to set up your account, fill out the required sections and under the organization name you are going to input “Beneficiary.”

Select these options below once you are logged into your account.

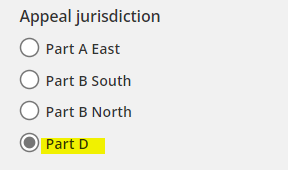

Select Part D when it asks to “Select Appeal Jurisdiction.”

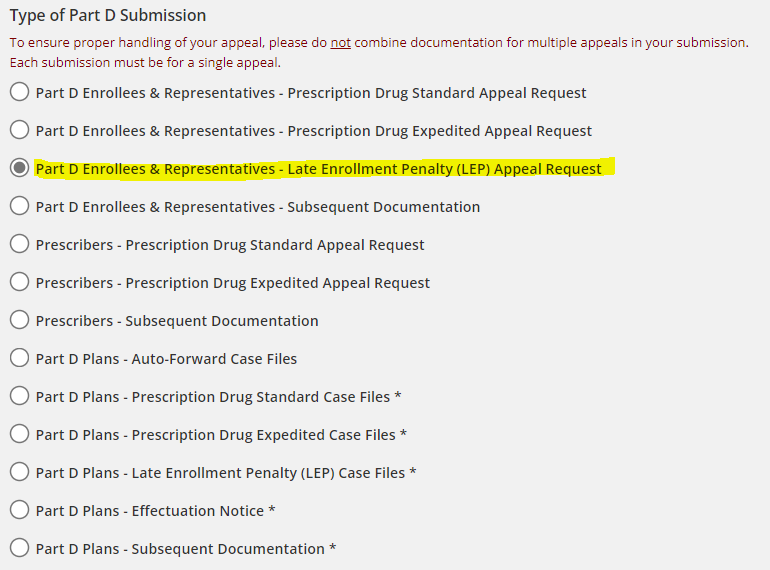

The type of Part D Submission will be Part D Enrollees & Representative – Late Enrollment Penalty (LEP) Appeal Request.

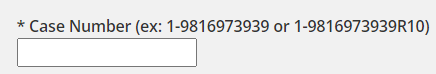

Leave this section blank if you do not have a case number assigned to you yet.

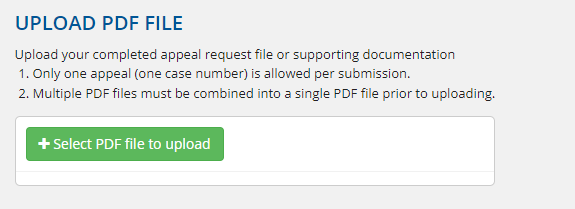

Your appeal request and any supporting documentation must be uploaded as a single PDF.

Lastly, you will need to create a six-character nickname for your submission. You will refer to this nickname when inquiring about your appeal.

You will receive an email confirmation once your appeal is submitted successfully. Expect a response from C2C Innovative Solutions within 90 days after submitting your appeal. Of course, you are still expected to pay the LEP during the time your appeal is being processed. However, once your appeal is approved then your Part D plan will reimburse you for the LEP payments you made.

In addition, you will be able to check the status of your appeal on the Appeal Status Lookup Tool.

C2C Innovative Solutions will send you an acknowledgement letter after receiving your submission that will contain your Appeal Number.

C2C Innovative Solutions

Part D LEP Reconsiderations

PO Box 44165

Jacksonville, FL 32231-4165

Toll-free fax: (833) 946-1912

Customer Service: 833-919-0198

Trusted American Insurance Agency is a National Marketing Organization (NMO) headquartered in Rocklin, CA. Trusted American provides a full range of insurance and financial services products across all 50 states for all major and niche carriers, with a specialty in the Senior Marketplace.

Maine Extends Scope of Its Whistleblowers’ Protection Act

On April 12, 2022, Maine adopted LD 1889, a bill that extends the scope of the state’s Whistleblowers’ Protection Act (the Act) to include employees who work under a collective bargaining agreement. The amendment goes into effect July 19, 2022. Specifically, LD 1889 repeals a section of the Act that the Maine Supreme Judicial Court interpreted in Nadeau v. Twin Rivers Paper Company, LLC as a bar to enforcement of the Act in many cases in which a collective bargaining agreement is in place.

Massachusetts Orders Treble Damages for Late Wage Payment

On April 4, 2022, the Massachusetts Supreme Judicial Court (the court) found in Reuter vs. City of Methuen that the Massachusetts Wage Act (MWA) requires employers to promptly pay employee wages, and that employers that pay late are subject to a penalty of up to three times the amount of unpaid wages.

PLEASE JOIN US FOR OUR FREE MONTHLY EDUCATIONAL MEDICARE SEMINARS

Will you be turning 65 soon or do you have employees that are turning 65?

If so, this is the perfect time to connect with Imperial Coverage.

Our goal is to talk to you in the beginning, to help you get set up for the Medicare solution that’s going to be right for you.

In the beginning you want to make sure that you are making the choices that keep you away from late enrollment and penalties. Often people rely on other insurances that mistakenly delay their enrollment and cause them to have trouble enrolling and expose them to lifetime penalties.

We show what you need to do and educate you on what you need to know, prior to your 65th birthday. We will set you up as a potential client for later on when you do need Medicare. At that point, we would find the type of insurance that’s the best fit for your individual needs.

We work with both individuals and business of all sizes that have employees that are turning 65 and need assistance.

We conduct free monthly educational seminars at our facility and are also available to hold these meetings on site at your business location or virtually.

Please contact Imperial Coverage today to schedule a seminar or meeting: (631) 738-6760

OSHA’s Proposal to Reconsider and Revoke Arizona’s State Plan

On April 20, 2022, OSHA announced its proposal to reconsider and revoke the final approval of Arizona’s State Plan. This comes in response to the decade-long pattern of Arizona failing to adopt and enforce policies that are at least as effective as federal OSHA regulations. The proposal will be published in the Federal Register for public inspection on April 21, 2022. Public comments on this proposal must be submitted by May 26, 2022.

A MESSAGE FROM OUR CEO MARK LEGASPI: Annual Easterseals Long Island Golf Tournament September 19, 2022

It is that time of year to save the date for my Easterseals annual golf outing. As many of you may know, I am the New York State Chairman.

Easterseals was founded in 1919 as one of the first organizations to aid people with disabilities. For nearly a hundred years, Easterseals has provided programs that enable those with special needs to achieve equality, dignity, and independence in their own communities. Easterseals New York is a non-profit community-based organization dedicated to improving the health and welfare of New York State children and adults with special needs.

Please join me in the support of this worthy organization.

HHS Extends Public Health Emergency until July 15, 2022

On April 12, 2022, the Secretary of Health and Human Services renewed the COVID-19 pandemic Public Health Emergency, effective April 16, 2022. This will once again extend the Public Health Emergency period for an additional 90 days and as a result, numerous temporary benefit plan changes will remain in effect.

Important Definitions

Emergency Period. HHS issued a Public Health Emergency beginning January 27, 2020. This Emergency Period is now set to expire July 15, 2022 (unless further extended or shortened by HHS).

Outbreak Period. The Outbreak Period started March 1, 2020.The end date is applied on a participant-by-participant basis and is the earlier of 1) one year after the date the participant was eligible for relief, or 2) 60 days after the announced end of the COVID-19 National Emergency.

The following summarizes benefit plan provisions that are directly impacted by the extension of the Emergency Period and highlights the relief with respect to the ongoing Outbreak Period. Other temporary benefit plan provisions and changes that are allowed due to the ongoing pandemic are not included.

Benefit Plan Changes in Effect Through the End of the Emergency Period

- COVID-19 Testing. All group health plans must cover COVID-19 tests and other services resulting in the order for a test without cost-sharing (both in-network and out-of-network), prior authorization, or medical management and includes both traditional and non-traditional care settings in which a COVID-19 test is ordered or administered.

- Over-The-Counter (“OTC”) COVID-19 Testing: Beginning January 15, 2022, all group health plans must cover OTC COVID-19 tests for diagnostic purposes without cost-sharing (both in network and out-of-network), prior authorization, medical management and without requiring medical assessment or prescription. Plans may limit the reimbursement for the purchase of OTC COVID-19 tests to eight tests per month per enrollee. Plans with established networks and direct coverage may limit the reimbursement for out-of-network OTC COVID-19 tests to up to $12 or the actual cost of the test, if less.

- COVID-19 Vaccines. All non-grandfathered group health plans must cover COVID-19 vaccines (including cost of administering) and related office visit costs without cost-sharing; this applies, to both in-network and out-of-network providers, but a plan can implement cost-sharing after the Emergency Period expires for services provided out-of-network.

- Excepted Benefits and COVID-19 Testing. An Employee Assistance Program (“EAP”) will not be considered to provide significant medical benefits solely because it offers benefits for diagnosis and testing for COVID-19 during the Emergency Period and therefore, will be able to maintain status as an excepted benefit.

- Expanded Telehealth and Remote Care Services. Large employers (51 or more employees) with plan years that begin before the end of the Emergency Period may offer telehealth or other remote care services to employees (and their dependents) who are not eligible for other group health plan coverage offered by the employer.

- Summary of Benefits and Coverage (“SBC”) Changes. Group health plans may notify plan members of changes as soon as practicable and are not held to the 60-day advance notice requirement for changes affecting the SBC during the plan year or for the reversal of COVID-19 changes once the Emergency Period expires, provided the plan members are timely made aware of any increase and/or decrease in plan benefits summarized on the SBC.

- Grandfathered plans. If a grandfathered plan enhanced benefits related to COVID-19 for the duration of the Emergency Period (e.g., added telehealth or reduced or eliminated cost-sharing), the plan will not lose grandfathered status if the changes are later reversed when the Emergency Period expires.

Benefit Plan Changes in Effect Through the End of the Outbreak Period

On an individual basis, group health plans, disability, and other employee welfare benefit plans will disregard the period of one year from the date an individual is first eligible for relief, or 60 days after the announced end of the National Emergency, whichever occurs first, when determining the following:

- COBRA. Timeframe for the employer to provide a COBRA election notice; the 60-day election period for a qualified beneficiary to elect COBRA; the COBRA premium payment deadlines (45 days for initial payment, 30-day grace period for ongoing payments); the deadline to notify the plan of qualifying events or disability determinations.

- HIPAA Special Enrollment. 30 days (60 days for Medicaid/CHIP events) to request a special enrollment right due to loss of health coverage, marriage, birth, adoption, or placement for adoption.

- ERISA Claims Deadlines. Timeframes to submit a claim and to appeal an adverse benefit determination. For non-grandfathered medical plans, timeframes to request external review and perfect an incomplete request.

- This includes claim deadlines for a health FSA or HRA that occur during the Outbreak Period.

- Fiduciary Relief of Certain Notification and Disclosure Deadlines for ERISA Plans. A plan will not be in violation of ERISA for a failure to timely furnish a notice, disclosure, or document throughout the duration of the Outbreak Period if the plan and fiduciary operate in good faith and furnish the notice, disclosure, or document as soon as administratively practicable (which may include the use of electronic means such as email and text messages).

Note: There is retroactive application with respect to COBRA, special enrollment rights for birth of a child or adoption, and claims.

Employer Action

Employers should continue to adhere to the national pandemic-related benefit changes and expanded timeframe for providing COVID-19 testing and vaccinations and other plan requirements. State and local emergency measures may expire at different times and could impact employee benefit plans (such as insured group health plans) and other state and/or local programs (such as paid leave) differently than the timeframes required under federally regulated program requirements.

This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional.

Virginia to Require Employers to Display Seizure First Aid Poster

On April 7, 2022, Virginia approved a measure that will require employers with 25 or more employees to display a new required seizure first aid poster in the workplace. The new requirement becomes effective July 1, 2022.