As we journey through life, the health of our brain becomes increasingly important, especially for those of us who are Medicare beneficiaries. June marks Alzheimer’s & Brain Awareness Month, a time dedicated to raising awareness about Alzheimer’s disease, other dementias and emphasizing the importance of brain health. Understanding your Medicare coverage benefits is key to taking proactive steps to support your cognitive well-being.

Understanding Alzheimer’s Disease

Alzheimer’s disease is the most common form of dementia, affecting millions of people worldwide. It is a progressive brain disorder that gradually impairs memory, thinking, and behavior. While aging is a significant risk factor, Alzheimer’s is not a normal part of aging. It affects about one in nine people aged 65 and older, making it a critical issue for the Medicare community.

The Alzheimer’s Association defines three general stages of Alzheimer’s:

Early-stage Alzheimer’s (mild)

Middle-stage Alzheimer’s (moderate)

Late-stage Alzheimer’s (severe)

“Every 65 seconds, someone in the US develops Alzheimer’s.”

Alzheimer’s Association

Early Detection & Brain Health with Medicare Coverage

Early detection of Alzheimer’s can make a significant difference in managing the disease. It’s important to understand what’s included in your Medicare Benefits.

Original Medicare (Part A and Part B) will typically cover the diagnosis, evaluation, treatment, and care planning for Alzheimer’s at every stage. Original Medicare (Part A and Part B) will typically cover the diagnosis, evaluation, treatment, and care planning for Alzheimer’s at every stage.

Medicare Part A will cover:

- Inpatient medications (prescription drugs you may get during an inpatient stay)

- Medicare covers inpatient hospital care and some of the doctors’ fees and other medical items for people living with Alzheimer’s or another dementia who are age 65 or older.

- Home health care can be covered up 35 hours of in-home care per week depending on the circumstances. To receive this coverage, the patient must be “homebound” and need part-time skilled nursing care.

- Hospice care will be provided under Medicare Part A, with very little in out-of-pocket costs. In most cases, hospice care is provided in a patient’s home.

Medicare Part B provides coverage for a range of essential medical services, including:

- Annual Wellness Visits: Medicare offers a comprehensive annual wellness visit, including cognitive impairment assessments to catch early signs of dementia for timely interventions and better symptom management.

- Part B also covers a separate visit with a doctor or health care provider to fully review your cognitive function, establish or confirm a diagnosis like dementia or Alzheimer’s disease, and develop a care plan.

- Durable medical equipment such as a hospital bed or a wheelchair for in-home use.

Medicare Part A and Part B may also cover different mental health services including inpatient psychiatric are and outpatient services such as counseling and behavioral health specialist care.

If you or a loved one notice memory loss or cognitive changes, don’t hesitate to discuss it with your healthcare provider. Early diagnosis can lead to better treatment options and support services!

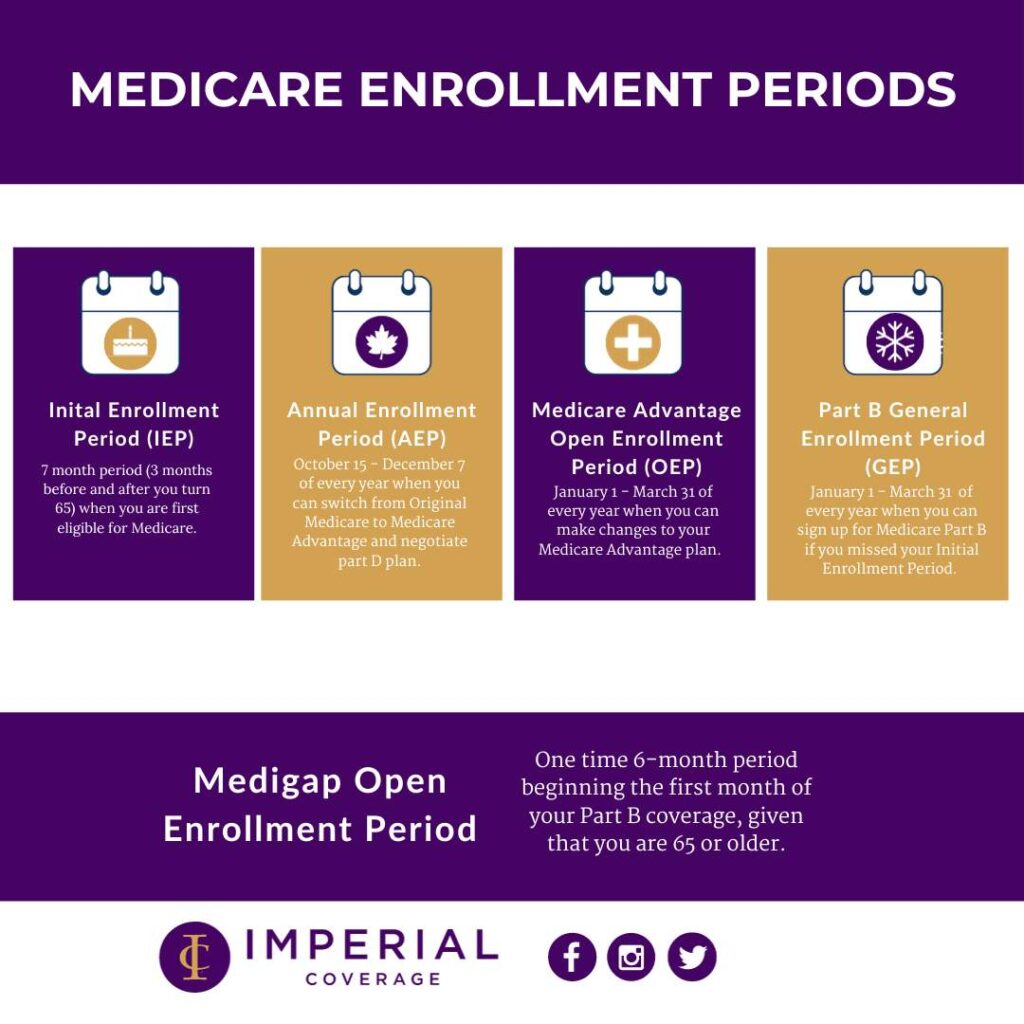

Medicare Part D Benefits:

If the person living with dementia has Medicare, then he or she can enroll in Medicare’s Part D prescription drug plan.

Medicare collaborates with insurers and private companies to provide a range of prescription drug plans, each differing in cost and covered medications. During the Medicare Part D annual open enrollment period (October 15th to December 7th), Medicare beneficiaries have the opportunity to enroll in a drug plan. Those already enrolled in a Part D drug plan can also switch to a different plan during this period.

Tips for Choosing Your Part D Plan:

- Check if the plan covers most or all of the drugs you currently take.

- Ensure your Alzheimer’s drugs are on the formulary.

- Confirm the plan covers the doses you need.

- Review if the plan’s rules restrict coverage of your Alzheimer’s drugs or require prior approval.

- Check if the plan requires you to try a cheaper drug before covering your current one (step therapy).

- Look for any quantity limits on pills covered in a given period.

- Compare all costs, including deductibles, copayments, and coinsurance, not just monthly premiums.

- Verify if your local pharmacy is in the plan’s network, as mail order may be an option, offer incentives, or be required for prescriptions.

Promoting Brain Wellness Through Healthy Habits

While there is currently no cure for Alzheimer’s, research shows that a healthy lifestyle can help reduce the risk of cognitive decline. Here are some tips to keep your brain healthy:

- Stay Physically Active

- Eat a Brain-Healthy Diet

- Stay Socially Engaged

- Keep Your Mind Active

- Get Quality Sleep

Alzheimer’s & Brain Awareness Month is a reminder that while aging is inevitable, we can take steps to protect our brain health. As Medicare beneficiaries, we have access to essential resources and services that can help us maintain cognitive function and quality of life. Let’s embrace this month as an opportunity to educate ourselves, support others, and commit to brain-healthy habits.

Contact us to learn more about your Medicare coverage benefits that can assist you with preventative services to promote your brain and cognitive health. You can also learn more about what’s included in Medicare Part A and B, and Part D, at Medicare.gov.